Income that temporarily reduces a retired individual s social security benefits.

Can i receive spousal social security benefits while still working.

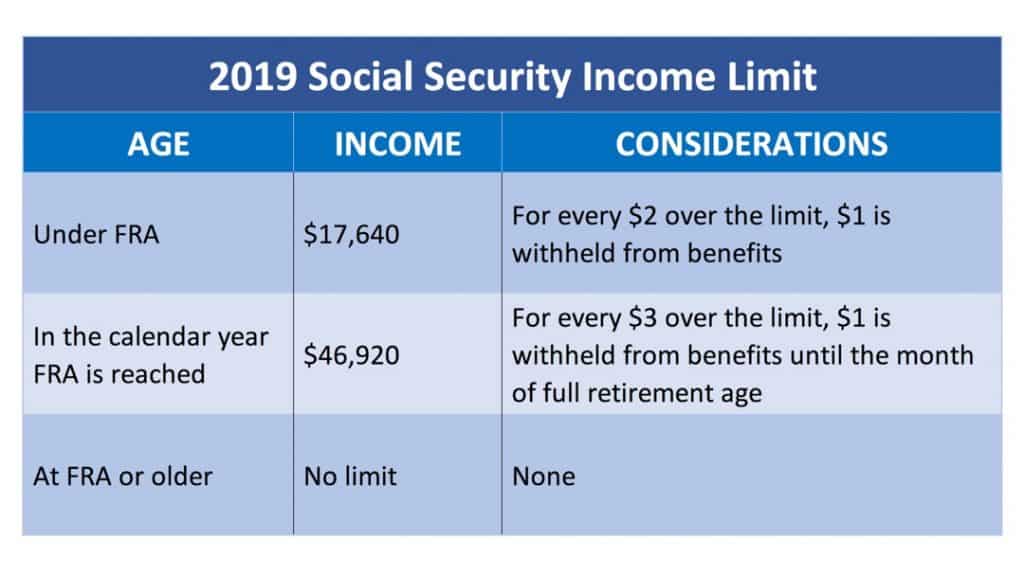

You may also continue to work but social security penalties apply to earned income over an annual limit during early retirement years.

You can get social security retirement benefits and work at the same time.

You can receive up to 50 of your spouse s social security benefit.

You can receive up to half of your spouse s benefit.

Social security pays benefits to four types of people who are still working.

She collects her spousal benefit while working for the next four years.

Social security is phasing in the fra increase differently for.

You may collect spousal benefits as early as age 62.

Each year we review the records of all social security beneficiaries who have wages reported for the previous year.

Spousal benefits for social security allow a spouse to collect social security based on the work history of the other spouse.

When you do it could mean a higher benefit for you and your family.

However if you are younger than full retirement age and make more than the yearly earnings limit we will reduce your benefit.

1 1954 so she files a restricted application for social security spousal benefits based on bob s earnings record.

The 4 main ways you can get social security and still work.

It does not apply if you receive spousal benefits because you are caring for a child who is under 16 or disabled or if you get spousal benefits and are also entitled to social security disability payments.

Kara age 66 is still working.

You can work while you receive social security retirement or survivors benefits.

Starting with the month you reach full retirement age we will not reduce your benefits no matter how much you earn.

Outside earnings from continued work only reduce social security benefits for individuals who.

Workers who claim their own retirement benefits before they.

Her husband bob is collecting social security retirement benefits.

Kara was born on or before jan.

Your spousal or survivor benefits may be reduced however if you are under full retirement age and continue to work.

If you were born after jan.

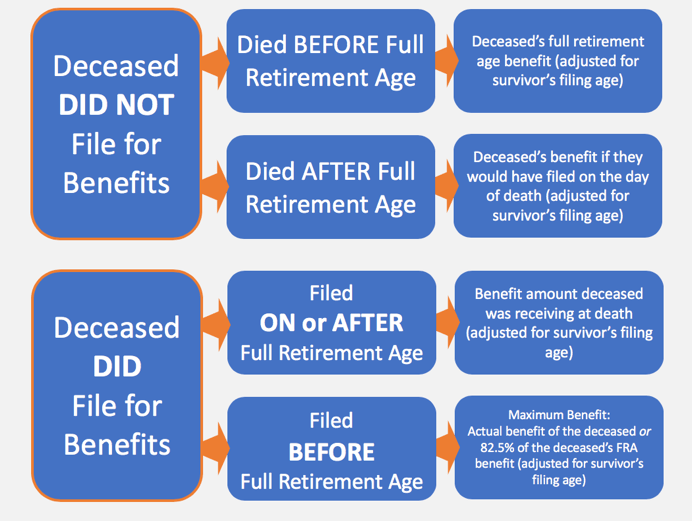

With survivor benefits if your late spouse boosted his or her social security payment by waiting past fra to file your survivor benefit would also increase.

If you never worked but are married to someone who s entitled to social security benefits you can claim benefits based on his or her work.

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

:max_bytes(150000):strip_icc()/GettyImages-172756810-bec49a3e76b64db4a8517bc1a2dd78c4.jpg)

:max_bytes(150000):strip_icc()/GettyImages-183299170-919b5e89adba45e0ab3ce620613369a1-b9d5a218bdd546cc92b3994b94d76a59.jpg)